Managing Deposits in Puree

Setting Deposit Requirements

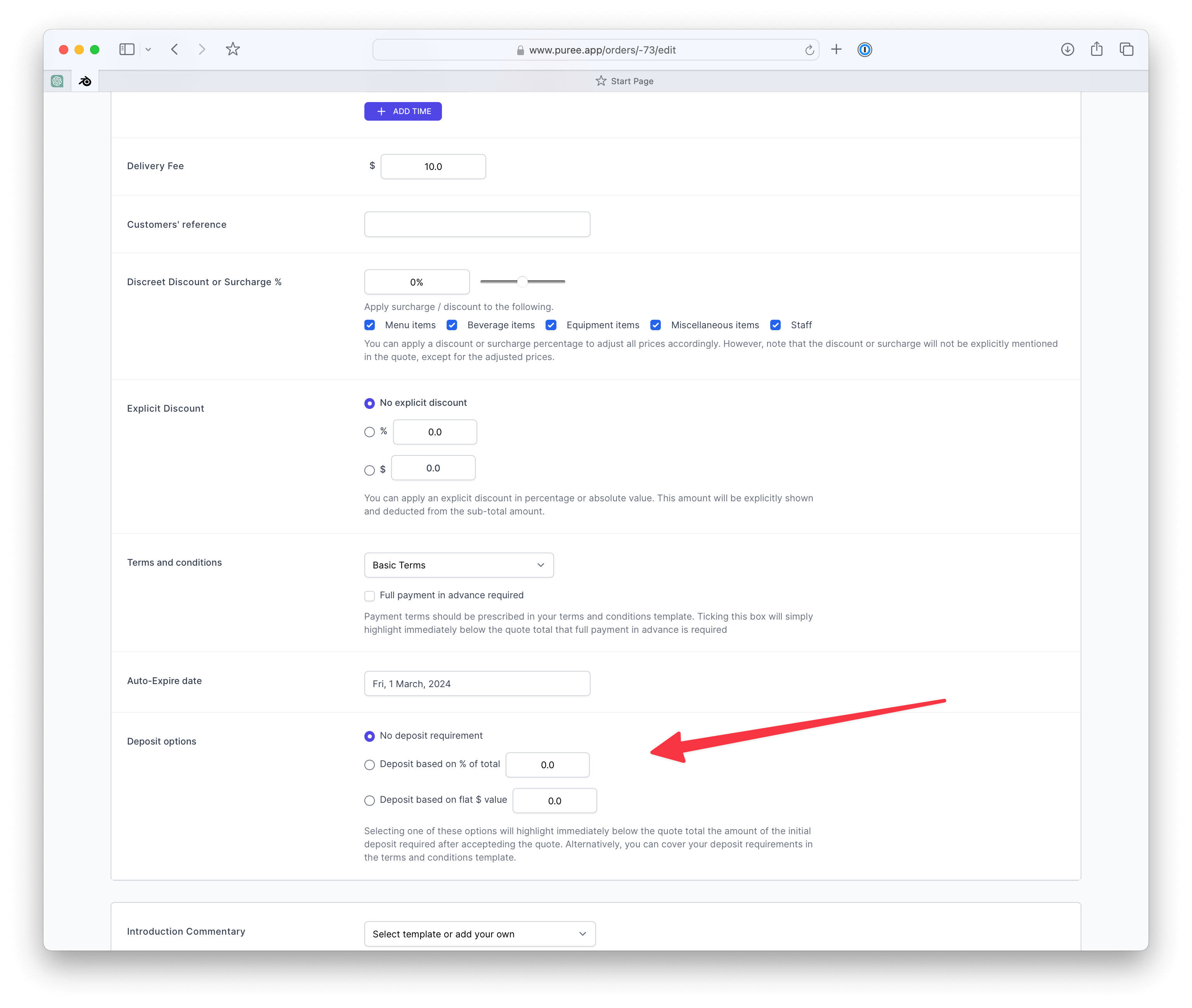

- Deposit Options: When creating or editing a quote locate the ‘Deposit Options’ section. You have two choices for how you set the deposit:

- Percentage of the Total Quote: Ideal for when you want the deposit to scale with the quote value.

- Flat Amount: Use this option to request a specific dollar amount for the deposit. For example, setting a $1,000 deposit.

- Save Changes: After selecting the preferred deposit option and specifying the amount or percentage, save your changes.

Customer Notification

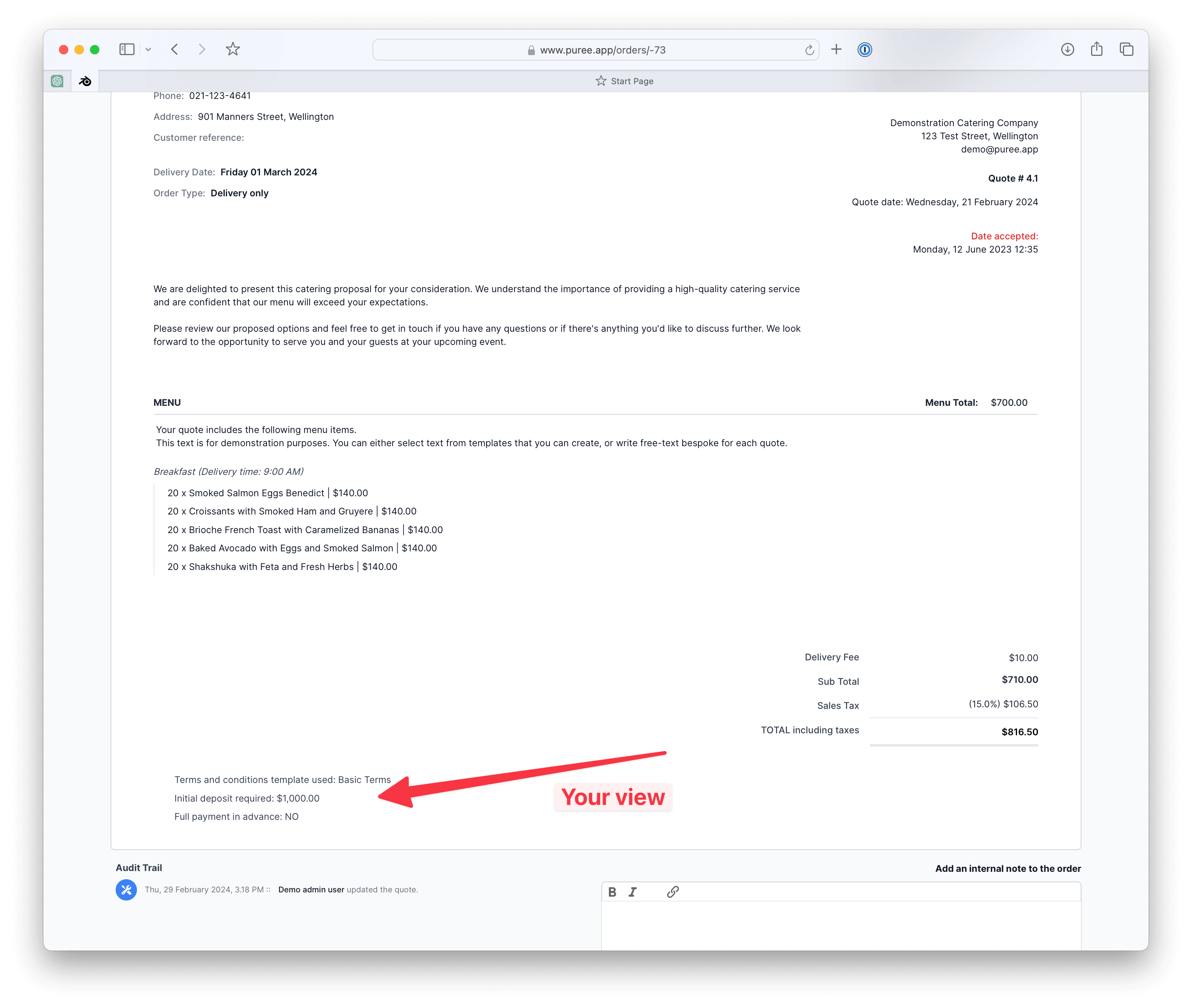

Upon saving, the quote will now reflect the deposit requirement. When customers view the quote, it clearly displays the deposit amount needed upon acceptance, ensuring transparency and setting clear expectations.

Handling Accepted Quotes

Once a customer accepts a quote with a deposit requirement:

- Invoice the Deposit: Through your invoicing system (e.g., Xero, MYOB), create and send an invoice for the deposit amount to the customer.

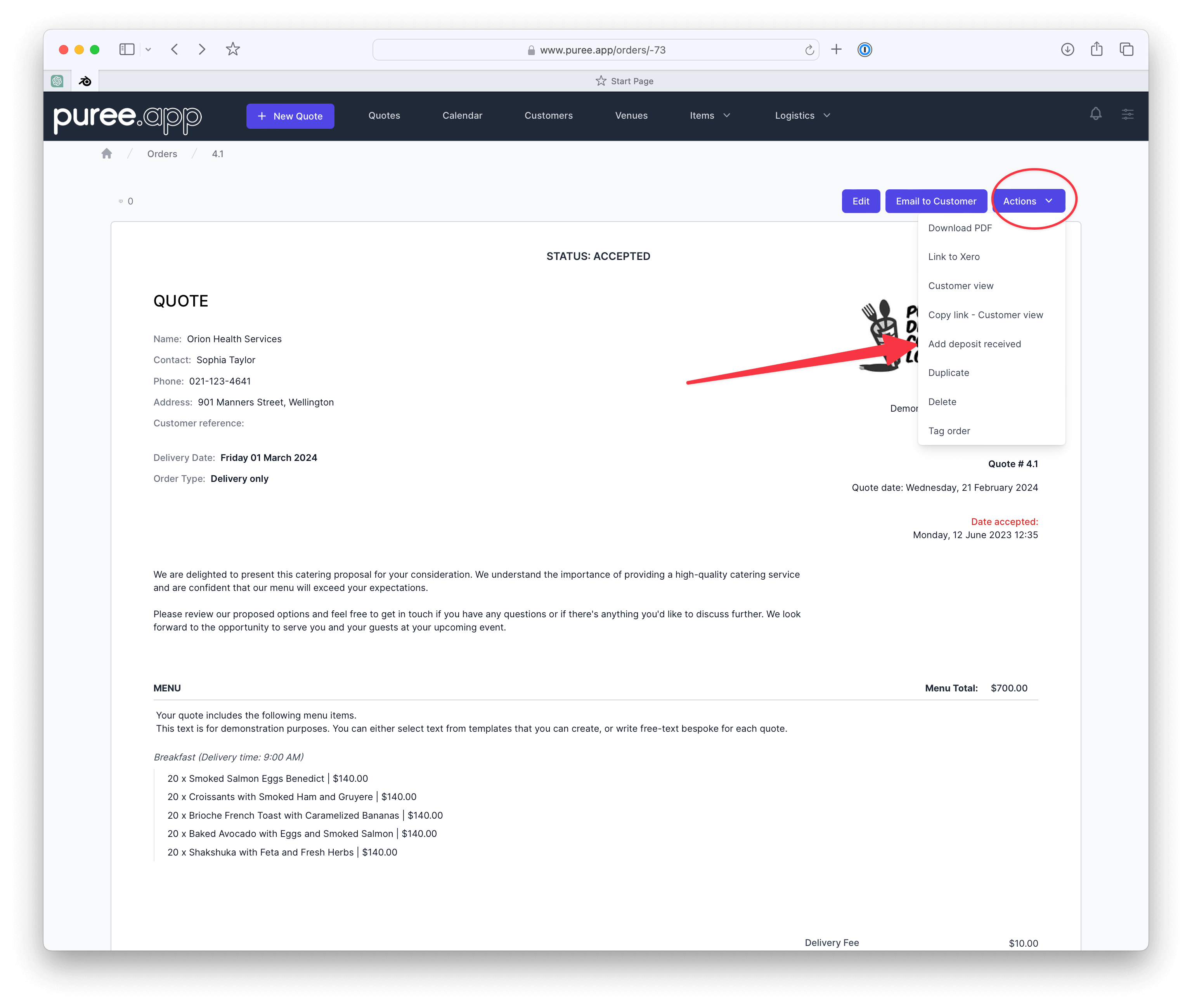

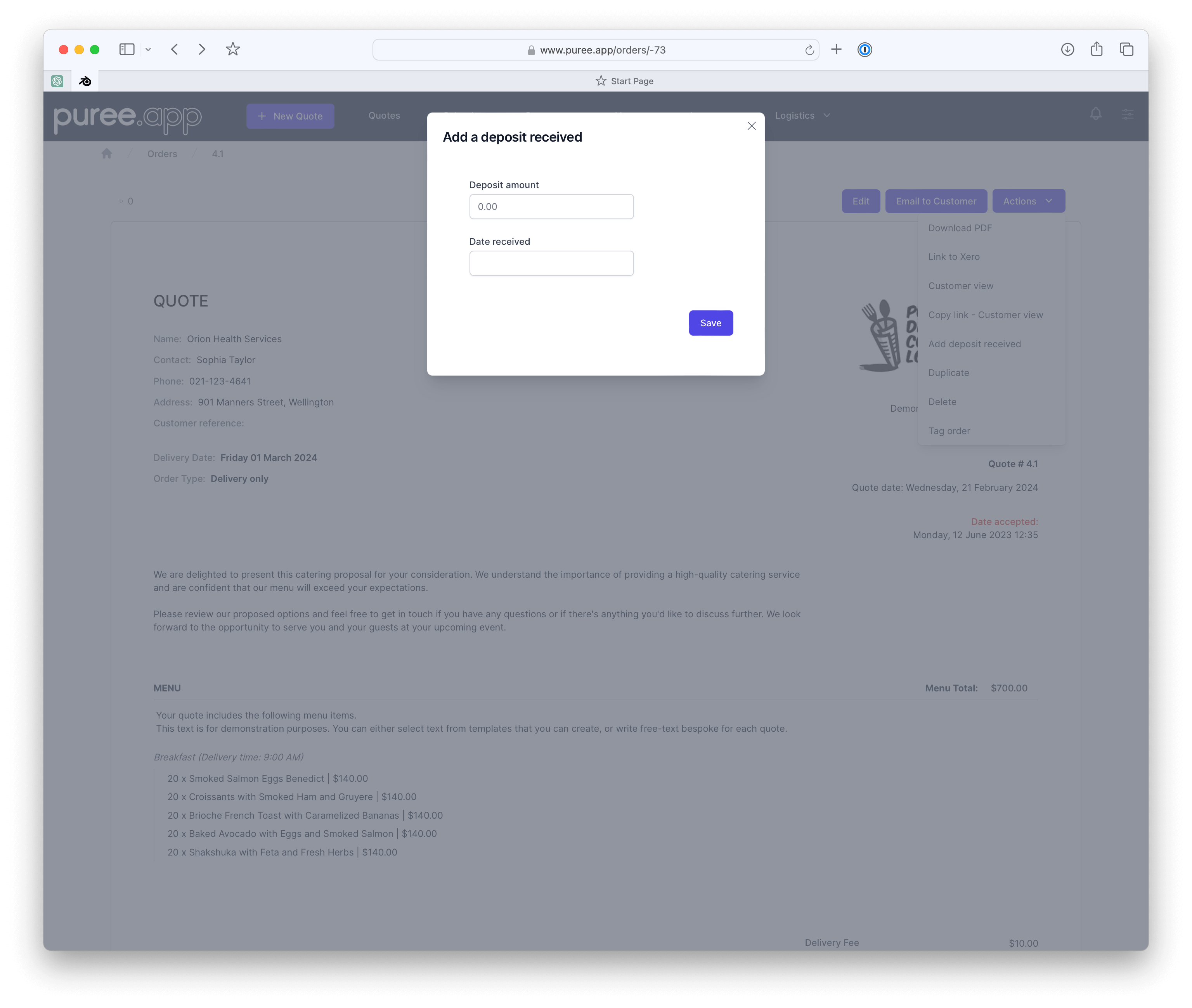

- Record Deposit Receipt: After receiving the deposit payment, go to the ‘Actions’ menu in Puree for the relevant quote and select ‘Add Deposit Received’. Enter the amount received and the payment date. You can enter multiple deposit payments.

- Refresh to Reflect Deposit: Refreshing the page will show the deposit as received in Puree, providing a clear record of payment.

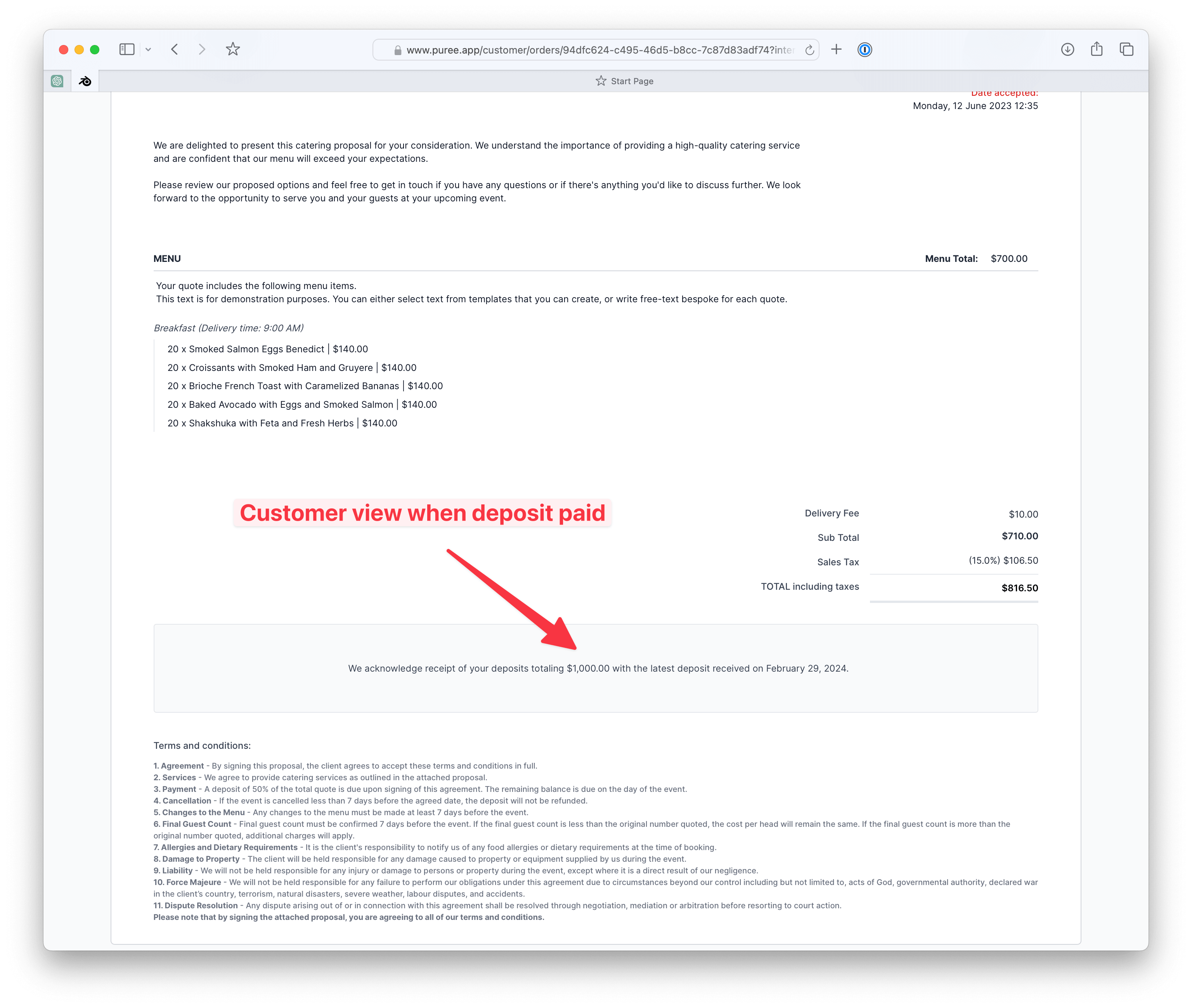

Customer View

The customer’s view of the quote will now be updated to acknowledge the receipt of the deposit. It will display the total deposits received and their dates, reassuring customers their payments have been accounted for.

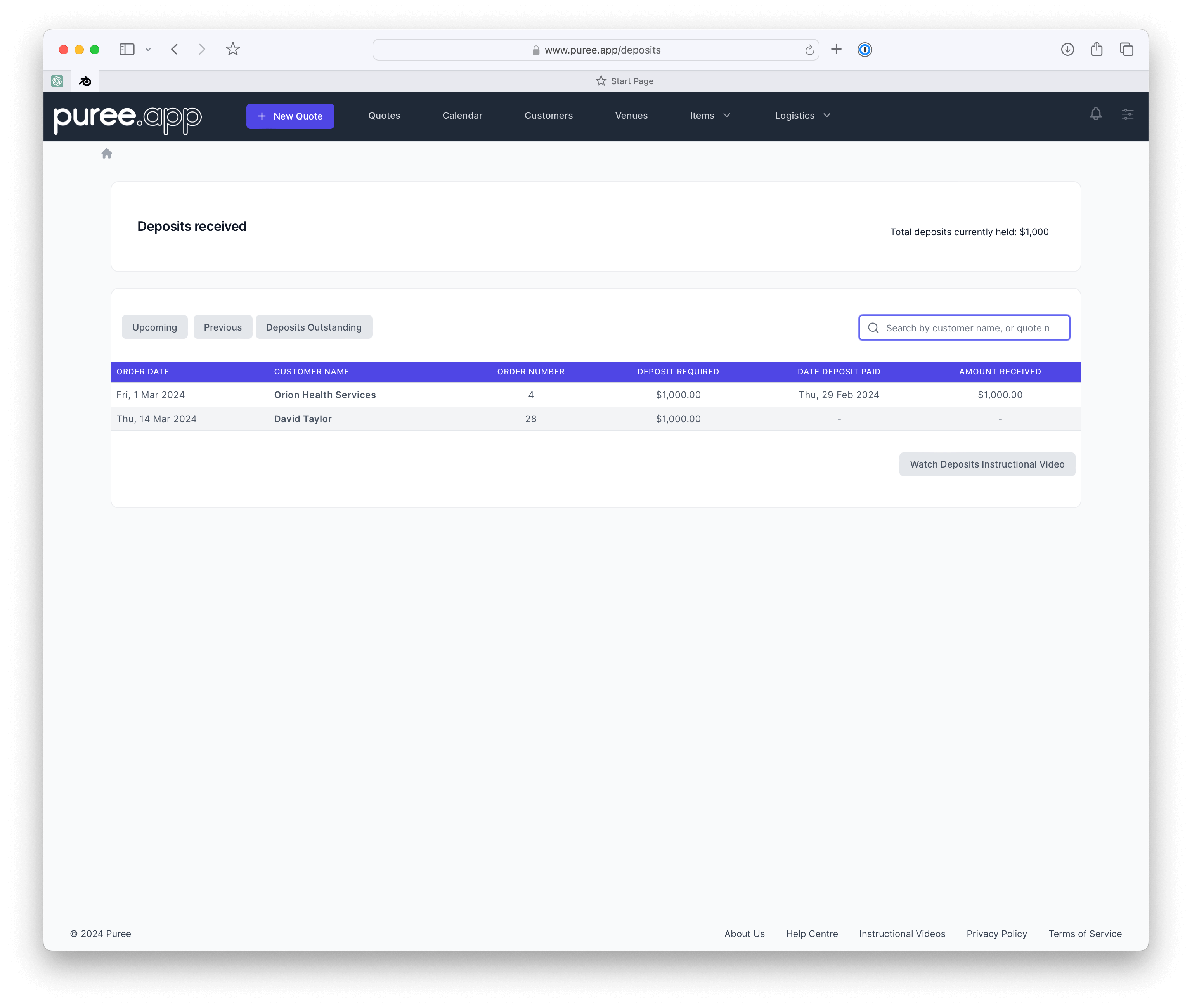

Tracking Deposits

To overview all deposits:

- Access Deposits Held: Navigate to the ‘Admin’ section and select ‘Deposits Held’. This area provides a summary of all deposits, including those pending payment.

- Manage Deposits: Use this feature to track unpaid deposits, enabling follow-ups with customers as needed.

Watch Our Tutorial on the Venue feature in Puree

Conclusion

Managing deposits in Puree streamlines the financial aspects of securing catering events, offering both businesses and customers clarity and confidence in the booking process. By following these steps, you can ensure your deposit handling is efficient and transparent.